Proprietary Solutions

Daniel Research Group has developed an extensive inventory of proprietary methodologies and algorithms that address many common forecasting and market modeling design, development, and management challenges. While the primary user benefit in applying these methods is increased forecast accuracy, significant analyst and management time and cost savings have been realized by clients using these solutions in their forecasting process. The applications are implemented in Excel, with some also using VBA macros.

SegmentSolver™ - allocates a top-line forecast to segments defined by a range of parameters including Percent of Total, Compound Annual Growth Rate, Periodic Growth Rates, Trend in Periodic Growth Rates, and many other metrics. In addition, the user can shape the individual segment forecast to conform to a wide variety of functions and curves including discrete and anomalous direct input. The segment roll-ups always sum to the top-line input.

The applications based on this method include a number of support features and functions that facilitate efficient use of user time, allowing them to focus on their vision of the market. Multiple SegmentSolvers™, organized in a hierarchical architecture, efficiently produce multi-segmented output that represents the user’s market view with a minimum of input and operational effort.

MatrixSolver™- solves the problem of crossing two independently arrived at segmentations of the same forecast, e.g. unit shipments by vertical, and unit shipments by geography. While there may be a high degree of confidence in the independent segment forecasts, there may not be sufficient information available to directly compute the cross. This method allows the user to apply crossing estimates based on partial or incomplete quantitative evidence, or by quantitative expressions of qualitative assessments, to produce an intelligently informed output that meets all input criteria.

Additional criteria may be applied to set upper and lower boundaries to one of the segments when that segment represents a banded variable such as price, performance metric, or market categories such as company size. Multiple MatrixSolver™- may be organized and configured into a chain to produce a time-series output that meet additional criteria such as CAGRs.

New - TrendSolver™ - Computes the next or preceding value in a time-series as a function of the Compound Growth Rate computed from the first and last values, and the trend of the individual growth rates between each successive value in the time-series. It is useful in quickly providing the most likely next, or preceding value as the first forecast or retro-cast approximation.

New - GrowthSolver™ - Allows the user to construct a forecast that meets criteria for both the annual growth rates and the ending CAGR simultaneously. The user can change the relative annual growth rates while keeping the CAGR constant, or conversely, change the CAGR while maintaining the relative growth rate pattern. The lite version uses only excel cell logic. The advanced version, implemented in VBA, allows the user to force the output to meet exact values for all but one of the annual growth rates. GrowthSolver™ may also be applied to other time metrics such as quarters or months.

ShareSolver™- Forecasts market shares of competitive offerings at the products/services, or vendors using a weights and scores methodology. The algorithm includes a market phase variable as well as an installed base loyalty (inertia) component. Its primary benefit is in discovering the degree to which different competitive attributes influence market success, and therefor leading to realistic actionable recommendations.

New - PenetrationSolver™ – Forecasts the percent of a defined Total Available Market (TAM) that will purchase or use a product or service. The TAM maybe defined in terms of buyers/users, units of the product or service, or units of an enabling or prerequisites product or service. The penetration forecast uses the Fisher-Pry formulation of the Logistics (S-Shaped) function. The α and β parameters may be directly specified by the users, or derived from a regression analysis of a specified portion of the historic data time-series. The user may also forecast the density – average number of units of product or service per penetration unit. PenetrationSolver™ – may also be implemented using the Gompertz formulation of the Logistics function in those case where that formulation is better suited.

New - ProjectionSolver™ – Projects the current year unit shipments or revenues as a function of year-to-data monthly or quarterly actual results, and derived or estimated monthly or quarterly trends. Derived periodic trends may be computed with the overall growth or decline trends dampened or removed. The output of this solution may be passed to a GrowthSolver™ to update the current year forecast to reflect year-to-date actuals.

InstallBaseSolver™ - Computes the number of units remaining in an installed base in each year as a function of a Retention Rate Distribution (RRD) and unit ages. The RRD is a distribution table that specifies (for each annual cohort of Unit Shipments added to the installed base in each year) the percentage that will remain in the installed base at the end of each subsequent year as a function of age. The table is computed from inputs for the distribution function Mean, Standard Deviation, and Maximum Life. The parameters of the RRD, primarily the mean, vary over time, reflecting economic, demographic, technological, and market condition change. The output includes number of units remaining in the installed base, the number exiting, and the average age of the units remaining at the end of each year.

New - EquilibriumSolver™ (EQS) - Is an advanced Market Modeling and Forecasting application that simultaneously forecasts Unit Shipments, Installed Base Units, and Replacerment Rates for a product or service in a defined market. It incorporates many of the other Solver methods to create independent forecasts for Unit Shipments, Installed Base Units, and the Replacement Rate. The time-series for each of the input variables may also be derived from the time-series of the other two. The core EQS algorithm compares the independent forecasts to the dependent forecasts and modifies inputs or parameter settings to find an equilibrium solution that equalizes both forecasts. For more information down load the EQS Fact Sheet and the DRG Equilibrium Solver Approach white paper.

MarketSolver™ - Is a suite of Excel/VBA based applications that support the development, maintenance, and management of large-scale technology market forecasts. Each installation is custom designed and configured to meet exact client specification. Its primary features and capabilities provide solutions to many of the most challenging problems commonly encountered by technology market forecasters. MarketSolver™ provides users with the capability to:

Create or modify multiple taxonomy forecasts using, Top-Down or Bottom-Up logic, or both simultaneously.

Shift units or revenue/spending within or across multiple taxonomies such that the totals for higher aggregations do not change. This feature is specifically designed to facilitate negotiations among analysts with different perspectives such as geography, industry, technologies, etc.

Quickly modify, expand or transform taxonomies to new internal or custom client taxonomies.

Employ a wide range of forecasting methodologies including trending, adoption/penetration, and causal methods.

Easily allocate to items within taxonomies using ShareSolver™- or MatrixSolver™- methodologies.

Create and maintain over one million individual forecast time-series

MarketSolver™ significantly reduces analysts’ bandwidth, increases customer request response times, while improving on the predictive accuracy of your forecasts.

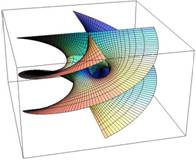

AdoptionSolver™ (DIAM) - Our three decades of experience in the technology sector has lead us to formulate a new theory of innovation adoption that is focused on the distribution of threshold values for observation of others buying. The distribution of these thresholds is the primary cause of much of the observed variance (saddles and surges) in the actual market. This agent-based methodology creates forecasts with superior descriptive, predictive and normative properties compared to other methods, and is particularly powerful in predicting the length and depth of saddles and surges.